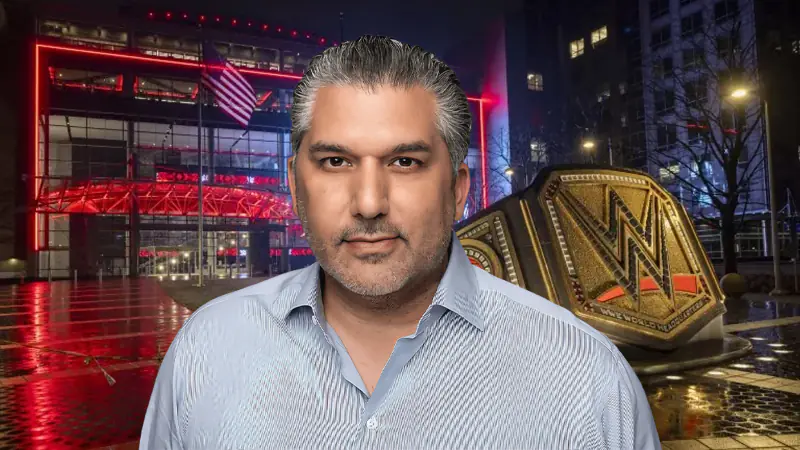

TKO Group, WWE's Parent Company Hits Record High With Stock Buyback Momentum

The financial momentum behind TKO Group Holdings, the parent company of WWE and UFC, continues to climb. On September 15, 2025, TKO shares spiked to an all-time high of $212.49, capping a remarkable run since the company first went public in September 2023.

Although the stock later closed at $200.29 on September 16, the surge represents a dramatic increase from the start of the year, when shares were trading at just $142.73.

Share Buybacks Driving Growth

The record-setting price came immediately after TKO announced it had repurchased $1 billion worth of shares as part of a larger $2 billion buyback program unveiled earlier in the month. Buybacks are a common strategy for companies to boost shareholder value, and in TKO’s case, the move has clearly inspired market confidence.

This isn’t the first high-profile transaction of the year. Back in the spring, Endeavor—the majority stakeholder in TKO—purchased roughly 1.58 million shares from former WWE Chairman Vince McMahon, further consolidating control of the company as McMahon stepped further away from his longtime empire.

A Busy Stretch for TKO

The stock market surge comes during one of TKO’s busiest periods on the global stage:

- Zuffa Boxing Debut: On September 13, TKO officially launched its new boxing brand, Zuffa Boxing, in partnership with Saudi Arabia’s General Entertainment Authority. UFC President Dana White is spearheading the project, which aims to bring blockbuster boxing back to mainstream audiences.

- Saudi Arabia WrestleMania: WWE confirmed that WrestleMania 43 in 2027 will be staged in Saudi Arabia, with the deal reportedly worth an eye-popping amount.

- ESPN Mega Deal: Just last month, WWE finalized a $1.6 billion partnership with ESPN, giving the network exclusive U.S. streaming rights for all Premium Live Events.

Context in Wrestling & Combat Sports

For fans of wrestling and combat sports, these moves underline just how powerful TKO has become. With UFC, WWE, and now Zuffa Boxing under one umbrella, the company is leveraging global partnerships and broadcast deals to build new revenue streams. The rising stock price is as much a reflection of investor confidence as it is of TKO’s aggressive push to reshape how combat sports and sports entertainment reach audiences worldwide.

🎙️ Wrestling.news | Backstage Take

It’s no surprise TKO’s stock is soaring. Between billion-dollar TV deals, Saudi mega-events, and the launch of Zuffa Boxing, the company is stacking revenue sources in a way no other combat sports organization can match. But while investors are celebrating, fans can’t help but wonder what this financial focus means for the in-ring product.

More money in the bank should mean more opportunities to innovate, create, and elevate wrestling and MMA for the fans. The concern, however, is whether WWE and UFC events become over-commercialized in the pursuit of shareholder returns. For now, though, one thing is certain—TKO is sitting at the top of the sports-entertainment business mountain, and the climb doesn’t look like it’s slowing down anytime soon.